The rise of cord cutting and streaming services meant consumers finally breaking away from the once-hated cable bundle. But if Warner Bros. Discovery CEO David Zaslav is right, that bundle might return in a new, but familiar, way.

Zaslav, who spoke during the Goldman Sachs Communacopia + Technology conference on Wednesday, didn’t directly address the ongoing dispute between Charter Communications and Disney, which has resulted in several key cable channels like ESPN and FX going dark on Spectrum cable, but hinted at its potential broader impact.

“Some of this disruption may activate a quicker transition to things like us in the content business bundling things together,” Zaslav said. “I’ve been a big advocate of the bundle.”

A return to a bundle of any sort would be ironic given the years that consumers agitated for a release from large packages of cable channels. The idea of a bundle is partly the cause of the dispute between Spectrum and Disney. Spectrum accuses Disney of forcing ESPN and Disney into more of its cable packages, even if a chunk of its audience doesn’t watch sports. It’s why Spectrum has called the video ecosystem “broken.”

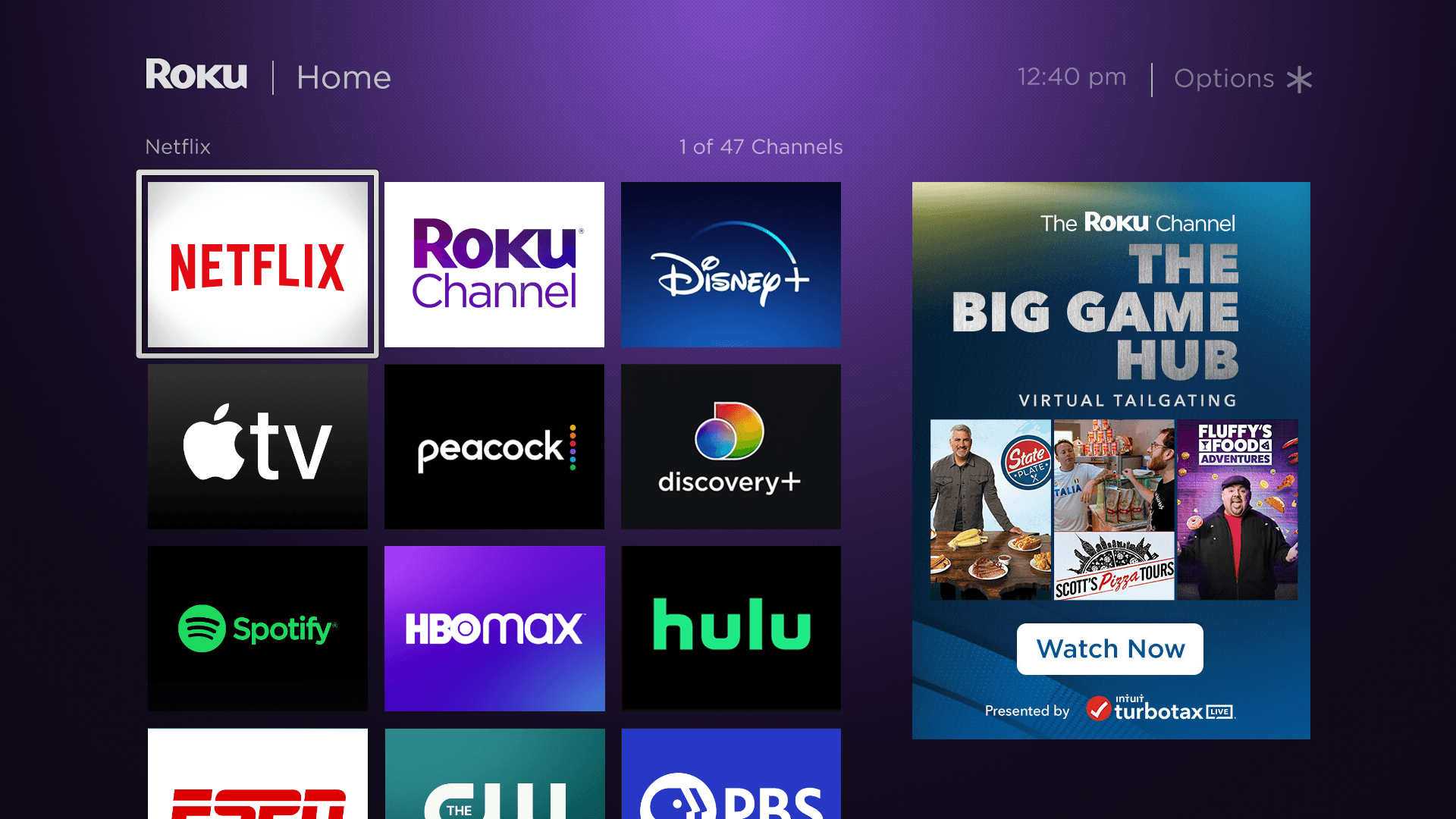

But the problem with the state of streaming is the extreme fragmentation of services and options, Zaslav said. While this has provided more choice and freedom for consumers, the sheer number of apps, platforms and services can be overwhelming to consumers.

“In the long term, it’s not a great consumer experience,” he said, noting that consumers have adapted to the new experience.

His vision of the bundle is the idea of more content living on the same service. This would make searching for specific content and browsing a library more useful to the user. Disney has floated this idea, but largely when it came to integrating its own services, such as Hulu and Disney+.

When it comes to companies working together, the notion faces tremendous hurdles. Each company has invested in its own platform, from Comcast’s Peacock and Paramount’s Paramount+, not to mention older stalwarts like Amazon’s Prime Video and Netflix. That doesn’t even include free ad-supported services like Paramount’s Pluto TV or Fox’s Tubi.

When asked if companies were holding conversations about this possibility, he said there were more talks over the last few months than the last few years. He noted the experiment where MAX highlighted some of AMC’s best content on its home page as a test of whether it would benefit both parties, suggesting that maybe more services offer different content over time.

MAX has struck deals to let its own content appear on other services, like Ballers on Netflix, but that was likely more of a financial decision than one borne out of serving the consumer. Zaslav also hinted as future price hikes for the service.

It’s hard to tell if Max, which has just 1.4% of the total streaming viewership, according to Nielsen, has the clout to force these kinds of industry changes. For now, we’ll have to keep navigating through the vast array of platforms and channels ourselves.