For weeks now, we have heard about how Sinclair Broadcast Group’s sports division Diamond Sports Group, would declare bankruptcy. Now it is being reported that Sinclair will not make a $140 million interest payment, according to the AP, a move that is expected to lead to bankruptcy.

Update: Diamond Sports Group has confirmed it will not make its $140 million payment today.

Missing this payment would start a 30-day grace period that is expected to lead to a Chapter 11 bankruptcy.

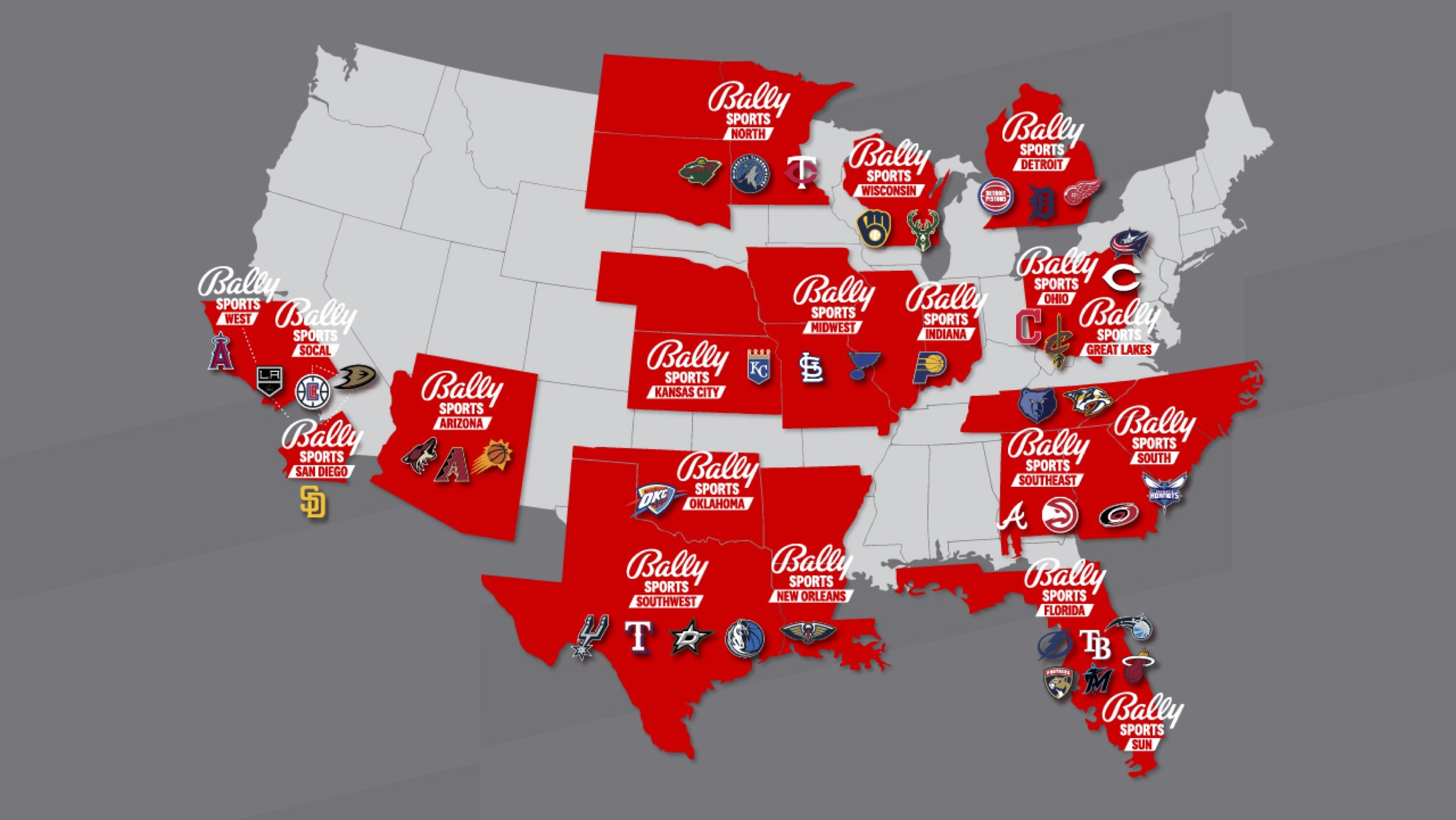

In total, Diamond has nearly $1 billion in sports rights payments due in the 1st quarter of 2023. Most of this is from the Bally Sports RSNs. It is being reported that bally does not have the cash on hand to cover all of its rights payments through 2023.

A chapter 11 bankruptcy does not mean Bally Sports will shut down. It seems that they are hoping to renegotiate their contracts with the MLB, NBA, and NHL. However, this could give leagues an option to try and get out of their contracts with Bally Sports.

MLB last week announced that they have plans in place to stream MLB games in the market if Bally Sports is unable to complete its contract with them.

For now, we will have to wait and see what happens, as Diamond Sports is likely to drag out any possible bankruptcy as long as possible.