Last week it was reported that Sinclair was preparing to declare bankruptcy in their sports division. Back in 2019, Sinclair purchased Fox Regional Sports networks for $10.6 billion from Walt Disney. This sale was one of the final steps to allow Disney to complete its purchase of 21st Century Fox. For Sinclair, though, things got off to a rocky start and have continued to go south.

In 2020 Covid shut down most sporting events, and a growing number of streaming services dropped the newly owned Fox RSNs. These challenges, along with others, have led Sinclair to look at spinning off their newly renamed Bally Sports Group into an independent company to help protect Sinclair from the losses its sports division was seeing.

Sinclair CEO Chris Ripley said that Sinclair hopes that Bally Sports, now a part of a subsidiary group Diamond Sports Group, will be able to become independent moving forward. Now we know that this newly independent group is reportedly preparing for bankruptcy.

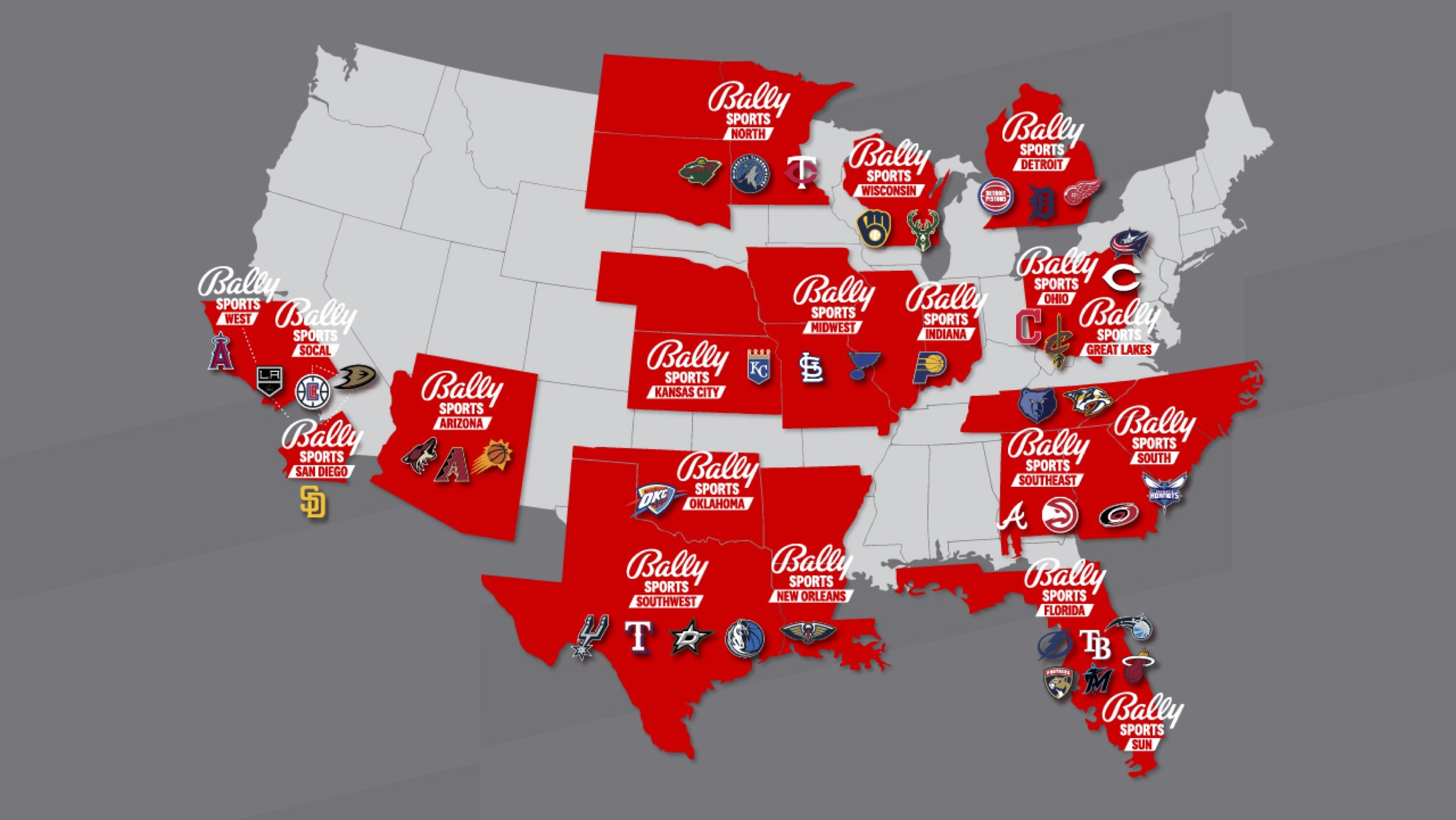

To help start the process of breaking Bally Sports out of Sinclair, they have hired David Preschlack to be CEO of the Diamond Sports Group to oversee all 19 regional sports networks. David Preschlack is a 20-year veteran of the industry with experience at NBC Sports and ESPN.

“David is the ideal person to lead Diamond at this critical point in its development,” said Randy Freer, Chairman of DSG’s Board of Managers in a press release earlier this month. “David possesses a unique combination of deep sports broadcasting expertise, sound business judgment, and a track record of successfully managing relationships with major sports leagues and multichannel video programming distributors that will be invaluable as we work to realize the full potential of DSG’s Bally Sports Networks.”

This is only one of the steps Sinclair is taking to help turn around their struggling Bally Sports Networks. This includes recently launching Bally Sports+, a $20 a month streaming service that lets customers watch their favorite local teams streaming online not only for out-of-market games but in-market games as well. This was one of the first in-market stand-alone regional sports streaming services ever to launch, a huge moment for cord cutting but at a high price.

So what went wrong for Bally Sports?

Even before Sinclair bought Fox Sports RSNs many services had started to push back on RSNs, including DISH Network which said RSNs are some of the most expensive networks, but the least watched networks. Even growing numbers of streaming services like YouTube TV have dropped Bally Sports and other RSNs over the high cost and low viewership.

Now Sinclair is facing plans from major sports groups to offer in-market streaming. There have been rumors for some time now that MLB and the NBA have been looking at options to allow in-market streaming as viewership continues to drop. This could mean that MLB and NBA are looking to pull back rights from RSNs.

It seems that Sinclair bought Bally Sports at a very high price, just as the value of RNS started to drop. Add in 2020, when most sports did happen, and this left Sinclair without expected revenue.

Now cord cutting is once again exploding as inflation has Americans looking for ways to cut back on expenses. This is leading to lower than expected revenue from cable TV subscribers.

Put this all together, and you have a perfect cord cutting storm to impact RSNs like Bally Sports. Leaving Sinclair reportedly looking to declare bankruptcy to cut back on costs at Bally Sports.

For now, we will have to wait and see what Sinclair and the Diamond Sports Group do next. When will this Bankruptcy happen, and what will it look like? We will have to wait to find out.